The difference between the expected and actual cost incurred on purchasing direct materials, expressed as a positive or negative value, evaluated in terms of currency. The material quantity variance is a subset of the quantity variance, since it only applies to materials (or, more accurately, direct materials) that are used in the production process. Reliable suppliers who consistently deliver quality materials at agreed-upon prices help maintain stable production costs.

Direct Materials Quantity Variance Calculator Online

We’ll also include examples to display the process of calculating your direct material price variance. In this example, the variance is negative (unfavorable), as the actual quantity of sheet used (1,200) was higher than the standard quantity (1,000), and therefore it cost the business more to produce the 500 items than it should have done. Material Cost Variance gives an idea of how much more or less cost has been incurred when compared with the standard cost. Thus, Variance Analysis is an important tool to keep a tab on the deviations from the standard set by a company. Effective management of direct material variance can lead to significant savings and better resource allocation.

- Reliable suppliers who consistently deliver quality materials at agreed-upon prices help maintain stable production costs.

- The direct materials quantity variance of Blue Sky Company, as calculated above, is favorable because the actual quantity of materials used is less than the standard quantity allowed.

- Specifically, knowing the amount and direction of the difference for each can help them take targeted measures forimprovement.

- Like direct materials price variance, this variance may be favorable or unfavorable.

- One such technique is the use of trend analysis, which involves examining variance data over multiple periods to identify patterns and trends.

Direct Materials Price Variance FAQs

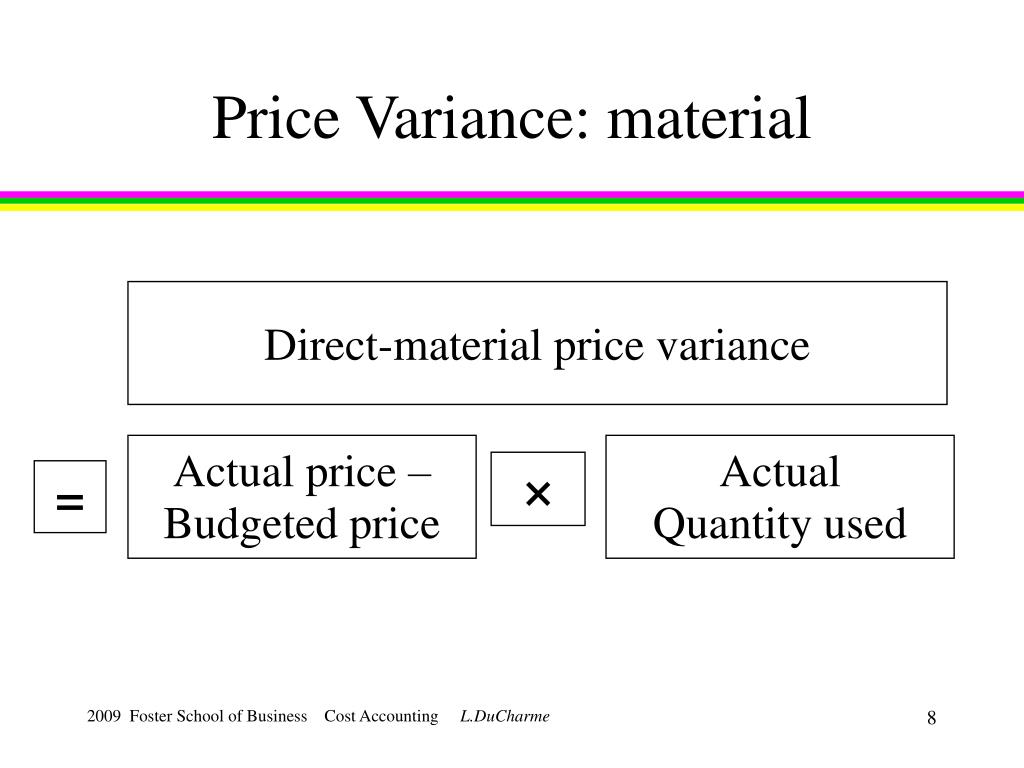

The direct materials used in production cost more than was anticipated, which is an unfavorable outcome. Direct material price variance (DM Price Variance) is defined as the difference between estates tax tips and videos the expected and actual cost incurred on purchasing direct materials. It evaluates the extent to which the standard price has been over or under applied to different units of purchase.

AccountingTools

In addition, recognizing the price variance when materials are purchased allows the company to carry its raw materials in the inventory accounts at standard cost, which greatly simplifies bookkeeping. The material price variance calculation tells managers how much money was spent or saved, but it doesn’t tell them why the variance happened. One common reason for unfavorable price variances is a price change from the vendor. Companies typically try to lock in a standard price per unit for raw materials, but sometimes suppliers raise prices due to inflation, a shortage or increasing business costs. The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity. This amount will represent the expected expenditure on direct material for this many units.

Direct Material Quantity Variance FAQs

Where,SQ is the standard quantity allowed,AQ is the actual quantity of direct material used, andSP is the standard price per unit of direct material. Another advanced technique is the application of statistical methods, such as regression analysis, to understand the relationship between different variables affecting material costs. By analyzing historical data, businesses can identify key drivers of variances and quantify their impact.

Related AccountingTools Course

In this question, Angro has experienced an unfavorable direct materials quantity variance because the actual usage of materials (i.e., 8,000kgs) is more than the standard quantity allowed (i.e., 7,500 kgs) to manufacture 5,000 units pf product. In other words, when actual quantity of materials used deviates from the standard quantity of materials allowed to manufacture a certain number of units, materials quantity variance occurs. The direct materials quantity variance is one of the main standard costing variances, and results from the difference between the standard quantity and the actual quantity of material used by a business during production. Additionally the variance is sometimes referred to as the direct materials usage variance or the direct materials efficiency variance. It is usually better to compute the variance when materials are purchased because that is when the purchasing manager, who has responsibility for this variance, has completed his or her work.

This formula is critical for understanding how actual spending tracks against estimations. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know.

Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success. Daniel S. Welytok, JD, LLM, is a partner in the business practice group of Whyte Hirschboeck Dudek S.C., where he concentrates in the areas of taxation and business law. Dan advises clients on strategic planning, federal and state tax issues, transactional matters, and employee benefits. He represents clients before the IRS and state taxing authorities concerning audits, tax controversies, and offers in compromise.

For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance. Armed with this knowledge, companies can focus their efforts on improving supplier lead times to achieve better cost control. Additionally, the use of variance decomposition allows businesses to break down complex variances into more manageable components, providing deeper insights into specific areas of concern. It’s important to note that direct material variance can be broken down into more specific components, such as price and quantity variances.

The actual cost less the actual quantity at standard price equals the direct materials price variance. The difference between the actual quantity at standard price and the standard cost is the direct materials quantity variance. Remember that a standard cost is the amount that you expect to pay for a good or service, especially when it comes to creating something. The actual quantity (1,200 sheets) of plastic is removed from the raw materials inventory at the standard price (4.00) giving a credit entry of 4,800 posted to the account. The standard quantity (1,000) which should have been used in production is transferred to work in process inventory at the standard price (4.00), giving a total debit entry of 4,000.

Leave A Comment