The ending inventory under LIFO would, therefore, consist of the oldest costs incurred to purchase merchandise or materials inventory. If all items are purchased at the same price, there will be no problem in determining the cost of either the ending inventory or the items sold. For retailers, this means that acquisition costs include the purchase price less any sales discounts, plus other freight charges, insurance in transit, and sales taxes that are incurred to have the product ready for sale. This is usually done by taking a physical inventory at least once a year, usually at year-end. A physical inventory is required, regardless of whether a firm uses the perpetual or the periodic inventory method.

How to Calculate Ending Inventory: A Comprehensive Guide

- Ending inventory is the value of goods still available for sale and held by a company at the end of an accounting period.

- Thus, after two sales, thereremained 10 units of inventory that had cost the company $21, and65 units that had cost the company $27 each.

- The weighted-average cost method calculates the average cost of all units in inventory, considering both the cost and quantity of each unit.

- The second sale of 180 units consisted of 20 units at $21 per unit and 160 units at $27 per unit for a total second-sale cost of $4,740.

Therefore, the method chosen to value inventory and COGS will directly impact profit on the income statement as well as common financial ratios derived from the balance sheet. Inventory may also need to be written down for various reasons including theft, market value decreases, and general obsolescence in addition to calculating ending inventory under typical how to get paid to be a caregiver for parents business conditions. Inventory market value may decrease if there is a large dip in consumer demand for the product. Similarly, obsolescence may occur if a newer version of the same product is released while there are still items of the current version in inventory. This type of situation would be most common in the ever-changing technology industry.

Example – LIFO periodic system in a merchandising company:

We are trying to determine how much the items we sold originally COST us – that is the purpose behind cost of goods sold. Next thing to remember, you can only use items that occurred BEFORE the sale (meaning, you cannot use a purchase from August 28 when calculating cost of goods sold on August 14 – why? It hasn’t happened yet). We will pick inventory from the different purchases and use the purchase price to calculate the cost of goods sold. Under the FIFO method, it is assumed that the inventory items that enter the system first are the first ones to be sold. Therefore, the costs assigned to the earliest units are charged to the cost of goods sold. Another approach is to use the quantities recorded in the company’s inventory system to calculate ending inventory.

Description of Journal Entries for Inventory Sales, Perpetual, First-in, First-out (FIFO)

This ratio is then applied to the net sales during the accounting period to estimate the cost of goods sold. Subtracting the estimated cost of goods sold from the cost of goods available for sale gives the estimated ending inventory. Figure 10.14 shows the gross margin, resulting from thespecific identification perpetual cost allocations of $7,260.

Thus, after two sales, thereremained 10 units of inventory that had cost the company $21, and65 units that had cost the company $27 each. Endinginventory was made up of 10 units at $21 each, 65 units at $27each, and 210 units at $33 each, for a total specificidentification perpetual ending inventory value of $8,895. The specific identification method of cost allocation directly tracks each of the units purchased and costs them out as they are sold. In this demonstration, assume that some sales were made by specifically tracked goods that are part of a lot, as previously stated for this method.

Calculations for Inventory Purchases and Sales during the Period, Perpetual Inventory Updating

At its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory, then subtracting the cost of goods sold (COGS). Advancements in inventory management software, RFID systems, and other technologies leveraging connected devices and platforms can ease the inventory count challenge. Figure 10.14 shows the gross margin, resulting from the specific identification perpetual cost allocations of $7,260. When calculating the Cost of Goods Sold for a sale, you must IGNORE the selling price.

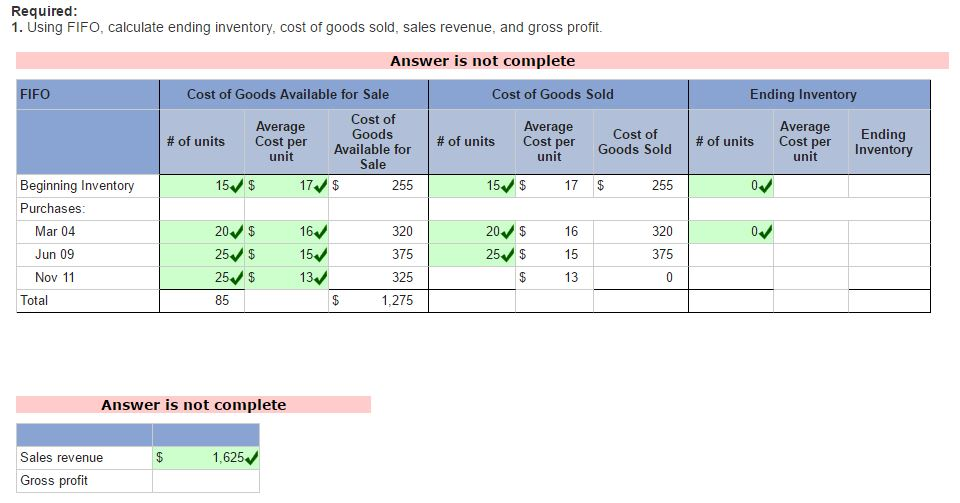

The FIFO costing assumption tracks inventory items based on lots of goods that are tracked, in the order that they were acquired, so that when they are sold the earliest acquired items are used to offset the revenue from the sale. The cost of goods sold, inventory, and gross margin shown in Figure 10.15 were determined from the previously-stated data, particular to perpetual FIFO costing. The LIFO costing assumption tracks inventory items based on lotsof goods that are tracked in the order that they were acquired, sothat when they are sold, the latest acquired items are used tooffset the revenue from the sale. The following cost of goods sold,inventory, and gross margin were determined from thepreviously-stated data, particular to perpetual, LIFO costing. The FIFO costing assumption tracks inventory items based on segments or lots of goods that are tracked, in the order that they were acquired, so that when they are sold, the earliest acquired items are used to offset the revenue from the sale. The cost of goods sold, inventory, and gross margin shown in Figure 10.7 were determined from the previously-stated data, particular to FIFO costing.

The first-in, first-out method (FIFO) of cost allocation assumes that the earliest units purchased are also the first units sold. For The Spy Who Loves You, using perpetual inventory updating, the first sale of 120 units is assumed to be the units from the beginning inventory, which had cost $21 per unit, bringing the total cost of these units to $2,520. At the time of the second sale of 180 units, the FIFO assumption directs the company to cost out the last 30 units of the beginning inventory, plus 150 of the units that had been purchased for $27.

The next step is to assign one of the three valuation methods to the items in COGS and ending inventory. Let’s assume the 200 items in beginning inventory, as of 7/31, were all purchased previously for $20. There are a couple of ways you can do them – there is an Inventory Record or a shortcut calculation. Most computer systems will show you the Inventory Record form so you need to understand how to read it. However, it can be time consuming and not practical for homework and test situations so you learn the alternative method as well. We will be using the perpetual inventory system in these examples which constantly updates the inventory account balance to reflect inventory on hand.

Thus, after two sales, there remained 75 units of inventory that had cost the company $27 each. Ending inventory was made up of 75 units at $27 each, and 210 units at $33 each, for a total FIFO perpetual ending inventory value of $8,955. At the time of the secondsale of 180 units, the FIFO assumption directs the company to costout the last 30 units of the beginning inventory, plus 150 of theunits that had been purchased for $27. Thus, after two sales, thereremained 75 units of inventory that had cost the company $27 each.The last transaction was an additional purchase of 210 units for$33 per unit.

Let’s return to The Spy Who Loves You Corporation data to demonstrate the four cost allocation methods, assuming inventory is updated on an ongoing basis in a perpetual system. On December 31, 2016, a physical count of inventory was made and 120 units of material were found in the store room. The Meta company is a trading company that purchases and sells a single product – product X. The company has the following record of sales and purchases of product X for the month of June 2013.

Leave A Comment